ECONOMISTS warned yesterday that the fast depreciating Zimbabwe dollar could further push up prices of basic goods and trigger fresh inflationary pressures on the economy. The economic experts noted that these were the same factors which triggered the 2007/2008 economic meltdown, which ended with 500 billion percent inflation and the collapse of the Zimbabwe dollar. Zimbabwe’s currency has suffered its worst battering on both the official and parallel markets in recent weeks, after the foreign exchange auction system struggled to fund allocated funds to companies.

ECONOMISTS warned yesterday that the fast depreciating Zimbabwe dollar could further push up prices of basic goods and trigger fresh inflationary pressures on the economy. The economic experts noted that these were the same factors which triggered the 2007/2008 economic meltdown, which ended with 500 billion percent inflation and the collapse of the Zimbabwe dollar. Zimbabwe’s currency has suffered its worst battering on both the official and parallel markets in recent weeks, after the foreign exchange auction system struggled to fund allocated funds to companies.

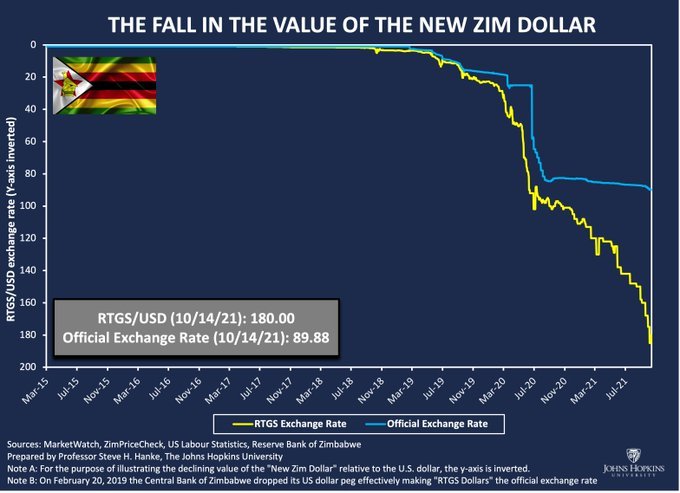

The volatilities have also eroded consumers’ buying power, leaving most families struggling to make ends meet. The economists spoke as the Reserve Bank of Zimbabwe (RBZ) said the currency traded at US$1:$105,6965 of the auction system on Tuesday this week, a sharp 5,8% decline from late week’s US$1:$99,9301 exchange rate on the formal market.

Parallel market rates soared to between US$1:$180 and US$1:$200, from between US$1:$160 and US$1:$170 the previous week.

CEO Africa Roundtable chairman Oswel Binha said earnings would be eroded before year end unless government takes action. He said the auction system was on the verge of collapse.

“There is a need for some form of a rational regulation on the Zimbabwe banking system. The real market is the parallel market which is currently trading at over $200 against the US dollar. If the situation remains like this, inflation will be way on top of the roof in Zimbabwe, which will see business profitability being affected,” Binha said.

“This will erode salaries and affect disposable incomes. The continued depreciation of the Zimbabwe dollar is the manifestation of the insufficiency of the US dollar in the market.

“Another problem is that there is a phenomenon that the costs of production are pegged at the parallel market, but revenue is pegged using the official exchange rate. The discrepancy is putting pressure to initiatives to save the values of shareholders and protect their profitability.”

Economist Eddie Cross said the current state of the economy was of major concern.

“When inflation exceeds a certain reasonable level, it affects the living standards of the majority of the people,” he said.

“We have to recognise the risks and dangers involved. At the moment, I would rate inflation as our number one enemy. There is high inflation throughout the world. Now we are importing a certain amount of inflation. This is a very important issue which we need to focus on.”

Confederation of Zimbabwe Retailers president Denford Mutashu agreed that the currency decimation would result in a reduction of purchasing power.

“Prices of goods and services will increase in local currency. Unfortunately, the trend in our economy has shown that whenever there are price increases in local currency, the US dollar prices follow suit,” he said.

A survey conducted by NewsDay showed that by yesterday, prices of basic commodities had increased by between 30% and 50% in the past month.

A two-litre bottle of cooking oil, which cost $400 last month, was selling at between $600 and $650 yesterday. A 10kg bag of mealie-meal, which cost $350 last month, now costs $550.

Consumers said they were worried over the market developments. Memory Masaire, a Chitungwiza resident, said: “My earnings have been eroded. It is becoming very hard to survive in Zimbabwe. There has been a notable increase in prices since the beginning of this month, but salaries have not increased”. Edgar Masanga, of Sunningdale in Harare, said there was so much inconsistency in prices. “Customers are paying higher than the actual value of commodities,” he said. “We are at the mercy of businesspeople that are manipulating the auction rates. Some are charging higher prices in the guise of cash discounts.”

On Wednesday, Finance minister Mthuli Ncube told Parliament that it would be difficult for the RBZ to bring sanity to the foreign currency auction system in the wake of rampant arbitrage opportunities.

Ncube said a lot of work had to be done to bridge the gap between parallel market rates and the official rate.

“We have put in place several measures to eliminate (the backlog) that exists on the auctions. On Tuesday, Treasury stepped in to clear the backlog, making sure that there is certainty and credibility around the auction,” he said.

“The way we do it is not that we are handing money over to the private sector through the auction, but rather, we are exchanging the US dollar that we collect from taxes for the Zimbabwe dollar that we need to settle civil servants’ salaries and other Zimdollar needs.”

Ncube said his ministry was working to ensure that the parallel market was under control.

“We are implementing other measures going forward to make sure that we reduce the cost of speculation and dampen the arbitrage opportunities that come with that,” he said.

“We will be requesting an adjustment in the tax bands as I present the budget just to make sure that those who are at the lower levels in terms of salaries can be cushioned through a tax relief.”

Ncube added that the introduction of price controls would be disastrous.

But others are not so certain: https://www.theguardian.com/global-development/2021/nov/17/dirty-dollars-how-tattered-us-notes-became-the-latest-street-hustle-in-zimbabwe

In Zimbabwe’s beleaguered economy, buying and selling half-shredded banknotes has become the latest hustle.

“Most of my clients are shocked that I actually buy such money. They love me for that,” says Kasani, showing a handful of filthy dollars which would be rejected in supermarkets or other businesses.

Zimbabweans are suspicious of banks and prefer to keep their money under pillows and beds. In previous crises, hyperinflation wiped out millions in savings, particularly in 2008. Now, there is a lack of favoured banknotes as they wear out faster than replacements come into circulation.

Shortages have led to the government telling banks and retailers not to reject old or worn US dollars, but many defy the order. A lack of exports means fewer new notes in circulation, and Zimbabweans are re-using increasingly grubby notes. Dealers either mend them or sell them on to others who will bribe or otherwise persuade senior bank officials to exchange large quantities.

“These torn notes are more valuable to me than new ones. These old notes, when taken to the bank, will be replaced at the same value, yet we would have bought them at nearly half the original value, depending on how bad they are,” says Kasani. All I need is the serial number and the necessary features for me to take.” Kasani sells old notes to business people and other cash dealers at 80% profit.

Steve Hanke is a professor of applied economics at The Johns Hopkins University and senior fellow at the Cato Institute. He is a columnist at Forbes and a regular contributor to The Wall Street Journal. Over four decades Hanke has advised dozens of world leaders from Ronald Reagan to Indonesia’s Suharto on currency reforms, infrastructure development, privatization, and how to tame hyperinflation. You can follow him on twitter @steve_hanke.

United States (US) economist, Steve Hanke, says President Emmerson Mnangagwa is not only corrupt but "totally ignorant" when it comes to economic issues.

In a tweet, Hanke said the Zimbabwe dollar has depreciated by 93% against the United States dollar since the local currency was reintroduced in 2019. He said:

Corrupt @edmnangagwa brought back the Zimbabwean dollar 2yrs ago. Since then, the Zim dollar has depreciated by 93% against the mighty USD. President Ed is not only corrupt but, when it comes to economics, he is totally ignorant. https://twitter.com/steve_hanke/

This comes as the forex rate has plummeted on the black market, with the currency changing hands for up to Z$200 per US dollar, while the official rate is pegged at Z$90. {npw $105}

Meanwhile, the Confederation of Zimbabwe Industries (CZI) – the largest representative body for local business, has warned that the country’s currency is in danger of collapsing as businesses resort to United States dollar transactions.

In a tweet on Tuesday, Hanke said threats by the Zimbabwean government to suspend businesses using black market rates will end in tears. He wrote:

"Zimbabwe's currency is in a "death spiral". Now, the corrupt government is threatening to suspend all businesses using black-market exchange rates to price goods. I’ve seen this movie before. It has a tragic ending."

Zimbabwean authorities have in recent weeks arrested scores of foreign traders accused of manipulating the volatile Zimbabwean dollar by trading on the black market.

But in a letter to its members, CZI said it had cautioned the government against clamping down on firms and traders. It said: The greatest risk facing the economy right now is an inappropriate policy response to the rising parallel market premium. Clamping down on informal exchange trading in the absence of a viable formal market will have catastrophic consequences for the economy.

"Every day I publish Hanke's #InflationSatellite. It's an interactive map that contains my accurate, up-to-date #Inflation measurements & black market (read: free market) data for 40+ countries. It is updated daily & currently contains data as of 10/13/21 Zimbabwe heading for the top od this unenviable chart with 98% Inflation - so far. Steve Hanke on Zimbabwe's Inflation Horror

Steve Hanke on Twitter Yet More Zimbabwe Corruption

Kudakwashe Tagwirei, who is close to Zimbabwe’s president and his inner circle, leveraged his privileged access to fuel and mining markets to strike a lucrative partnership with commodities giant Trafigura. Sanctioned by the U.S. and U.K. for corruption, Tagwirei continued to do business by relocating his network to Mauritius.

Key Findings

- Tagwirei has earned at least $100 million in fees from a partnership with Swiss-based Trafigura. Together, they have profited extensively by dominating Zimbabwe’s fuel market since 2013.

- Trafigura quietly extended $1 billion in loans to the Zimbabwean government, at exorbitant interest rates.

- As controversy grew, Tagwirei moved his business network offshore to Mauritius, where he secured a new near-monopoly fuel deal with the government. He is still active in mining and fuel deals in Zimbabwe.

- Government officials appear on key company records and Tagwirei’s own correspondence, indicating that there might be more powerful people behind the network

The payments made to Tagwirei raise a red flag, according to Global Witness’s Natasha White.

“Red flags include the personal involvement of politically exposed individuals in such deals. It would be extremely concerning if payments have been made into a personal account of Tagwirei by Trafigura, whether or not he was sanctioned at the time,” she said.